The Chancellor, Rishi Sunak’s much-anticipated announcement on 8th July 2020 to help boost the economy post lockdown has included welcome news for homebuyers which will also help to stimulate further activity in the property market.

The Chancellor confirmed there will be no stamp duty to pay on property purchases up to £500,000 until 31st March 2021.

Stamp Duty Land Tax is a lump-sum tax that has to be paid by anyone purchasing a property or piece of land in England or Northern Ireland (Scotland and Wales have their own systems) that costs more than a set amount. The tax is paid when the sale of a property is completed and is based on the final sum paid for that property.

Previously, the Stamp Duty threshold in England and Northern Ireland is £125,000, or £300,000 for first-time buyers (if buying a property worth less than £500,000) so this immediate increase in the threshold is positive news for homebuyers who can now expect to save thousands.

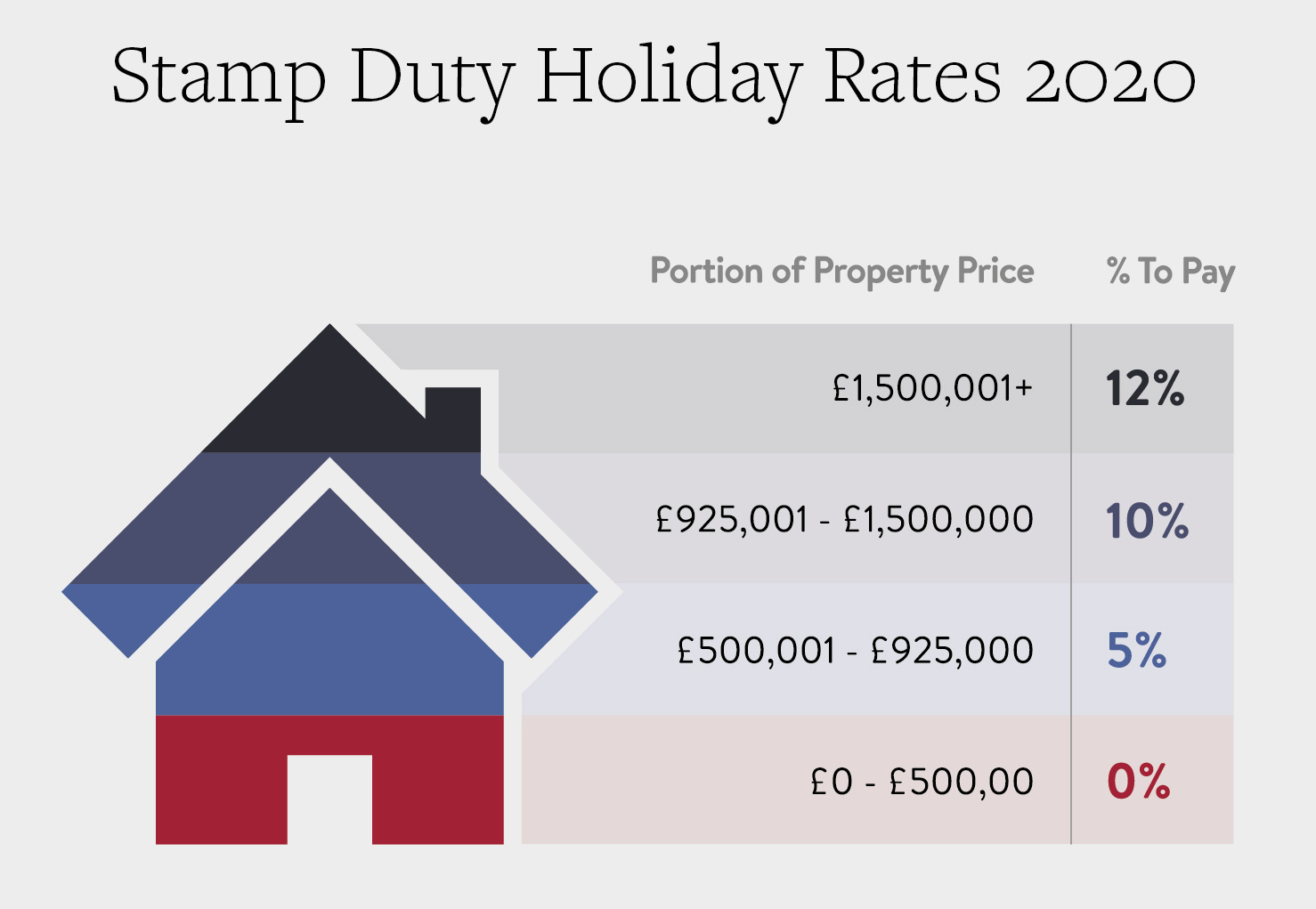

Changes to Stamp Duty until 31st March 2021

- £0 – £500,000 | No Charge

- £500,001 – £925,000 | Charged at 5%

- £925,001 – £1,500,000 | Charged at 10%

- £1,500,001 + | Charged at 12%

What does this mean if you’ve already got your house on the market?

This will have a positive effect on demand for houses as more potential buyers hit the market.

For many sellers when deciding to move home there is a chicken or egg moment – is it best to put your home on the market for sale before starting your property search, or do you find somewhere you would like to buy before placing your property on the market?

Our best advice is always to get your property on the market as soon as you can.

In the majority of cases it’s only when you have secured a buyer are you actually able to go out and capture your next home. The market will open up more to you and you’ll be in a better position to negotiate. It is incorrect to think that by selling first before you find somewhere to buy that you will somehow be pushed out of your home or be put under pressure to move quickly.

So, if you haven’t already got your house on the market, but are thinking about moving you need to make sure you have a buyer before you start to look for your next home.

Since the Chancellor’s announcement, we have seen an 71% increase in buyers and sellers visiting our website, compared to the same period last year.

This is a clear sign that more people are looking to move following this latest news, meaning now is a great time to get an up-to-date marketing appraisal of your home and get your moving plans underway.