First Time Buyers accounted for half the properties purchased with a mortgage in 2020 – thanks in no small part to the Help to Buy Equity Loan Scheme, which has helped more than a quarter of a million people to buy a home in the UK since its inception in 2013.

Despite its success to date, changes are being introduced this year to make the Help to Buy scheme more relevant and targeted towards helping First Time Buyers get onto the housing ladder.

Whilst the Help to Buy Equity Loan Scheme has been responsible for more than 280,000 property purchases since 2013, this year’s update presents some significant changes that we are going to provide a summary of below.

![]()

What Is Help To Buy?

Help to Buy Equity Loans, to give them their full title, provide a low-interest loan from the Government towards your deposit. You’ll need to have saved 5% of the purchase price to use as a deposit and the Government will lend you up to 20% of the value of the home, or up to 40% of the value of the home if it’s in London. A mortgage funds the remaining 75% of the purchase price (55% in London).

How Is Help to Buy Changing In April 2021?

From April 2021, Help to Buy is changing to make the scheme fairer on a national scale by introducing the following measures:

- Help to Buy will now only be available to First Time Buyers.

- Help to Buy is only available for the purchase of newly built or newly constructed properties.

- The old price cap of £600,000 has been replaced by regional purchase price caps, implemented in line with average property values in different parts of the country. In the South East, the maximum purchase price using Help To Buy from April is £437,600, which is much higher than somewhere like the North East where average property values are lower.

Who Can Use Help To Buy?

The new Help to Buy scheme is restricted to First Time Buyers from April 2021 – it is now strictly for purchasers who have not (either alone or with others) previously acquired via purchase, gift, trust or inheritance, a major interest in a dwelling or an equivalent interest in residential land situated anywhere in the world; and/or benefitted from any form of sharia mortgage finance.

The mortgage must be on a repayment basis and be a minimum of 25% of the market value of the property. There is no cap on the purchaser’s household income but applicants are still assessed on their affordability criteria.

Purchasers must always contribute a 5% cash deposit and it cannot be gifted or incentivised by the developer selling the property.

It’s worth noting however that providing a developer has had their funding application approved, buyers can move forward now with an application but will just not be allowed to exchange contracts on their new build property until after the 1st April 2021.

How Does Help To Buy Assist First Time Buyers?

Help to Buy significantly lowers the barrier for entry to the housing market, so much so that in 2020 First Time Buyers accounted for half of all homes purchased with a mortgage.

Help to Buy requires First Time Buyers to have saved 5% of the purchase price, so with properties included in the scheme in the South East having a maximum value of £437,600 – the minimum required deposit of 5% of the value of the property equates to £21,880.

The average price paid by a UK First Time Buyer in 2020 was £256,057, meaning a 5% deposit equates to just £12,802.85

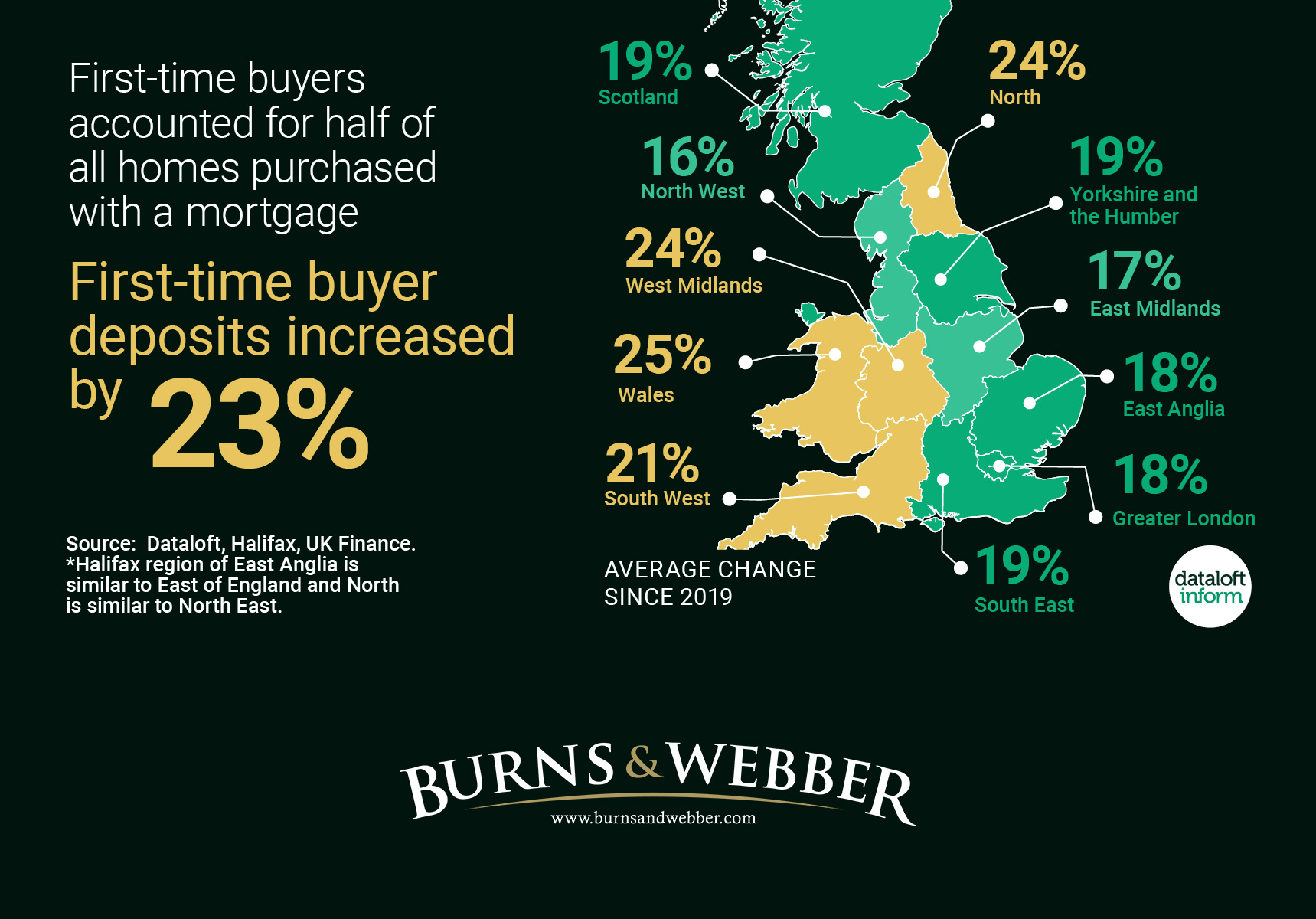

Throughout 2020 we’ve witnessed the amount that First Time Buyers put down as a deposit increase by 23%, meaning the average first time buyer deposit is now £57,278.00.

The graphic below compares average deposit sizes across the country in 2020.

In terms of the number of First Time Buyers getting onto the housing ladder in 2020, it’s not surprising we saw purchases decrease by -13% – the result of the chaos caused by the Coronavirus pandemic, a closed housing market in Spring and stricter mortgage lending. However, with movement restrictions easing in the second half of the year, First Time Buyer transactions recovered to be down just -2% on the same period in 2019.

Properties For Sale With Help To Buy

From April 2021 the use of Help To Buy to assist the purchase of your first home is only applicable to New Build properties, an example of which is Branksome in Godalming.

Branksome is a striking Victorian property with later Art Deco extensions. It was originally commissioned as a private school and is fashioned from local Bargate stone and adorned with elegant stone mullioned windows making it exude the grandeur of a bygone era. Now, almost 150 years later, Branksome enters the next chapter of its illustrious life with a sympathetic conversion into seventeen luxury apartments.

Prices from £200,000

Help to Buy available

Why Are New Build Properties So Attractive To First Time Buyers?

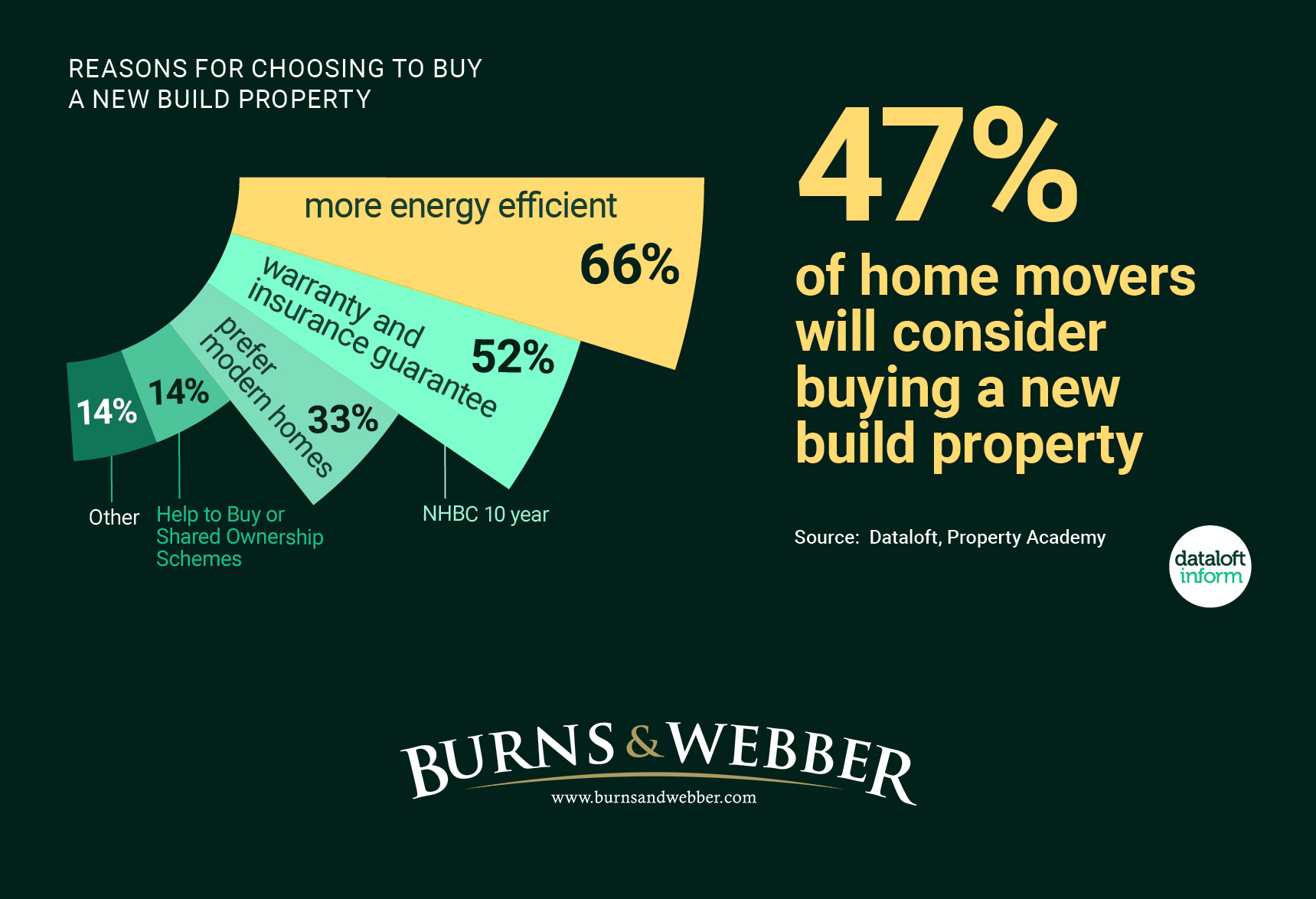

In a 2020 home moving trends survey by the Property Academy, almost half of home movers (47%) would consider buying a new build property, for a number of reasons:

- Energy Efficiency is the main reason why home movers would purchase a new build, especially amongst younger respondents under the age of 34 years (58%).

- Peace Of Mind offered by the security of the NHBC warranty, the cost of insurance or simply the lack of maintenance involved with a new property, is motivation for over half of potential new build buyers.

- Help To Buy or Shared Ownership Schemes are cited by one in five home movers under the age of 34 as particularly important when it comes to their moving plans.

- Interior Design and immaculate finishes on a new build are the other obvious reason to buy brand new.

If you are thinking about getting on the property ladder and you want to find out more, register your buying requirements with your local Curchods office and we would be delighted to send you details of the new Help to Buy developments that suit your individual purchasing situation, as and when they become available.

More questions about the Help to Buy Scheme can be found on the Government Website:

Source:

Dataloft, Halifax, UK Finance. * Halifax region of East Anglia is similar to East of England and North is similar to North East.

Property Academy.